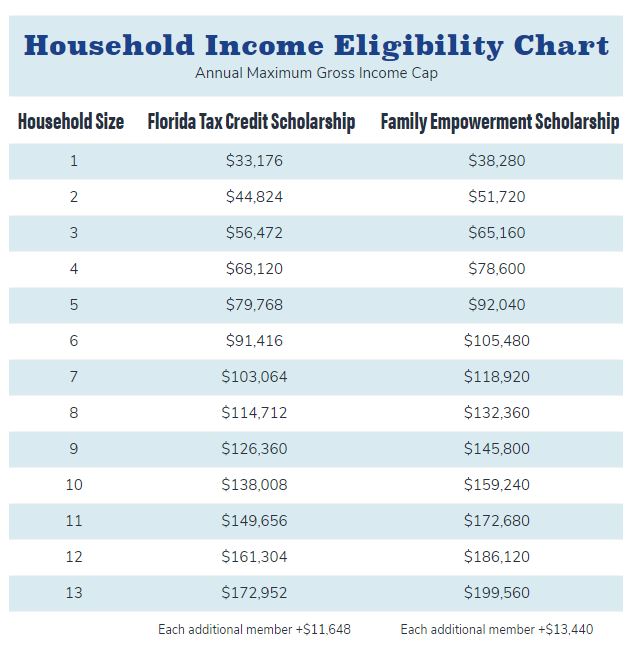

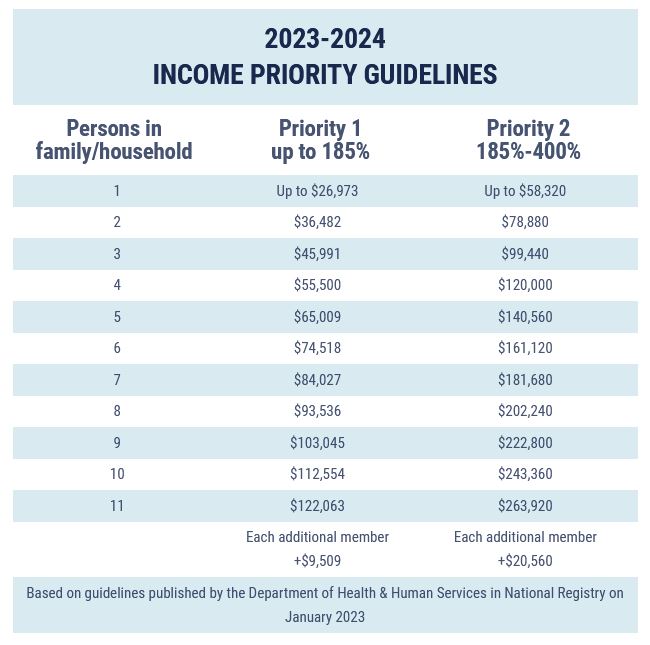

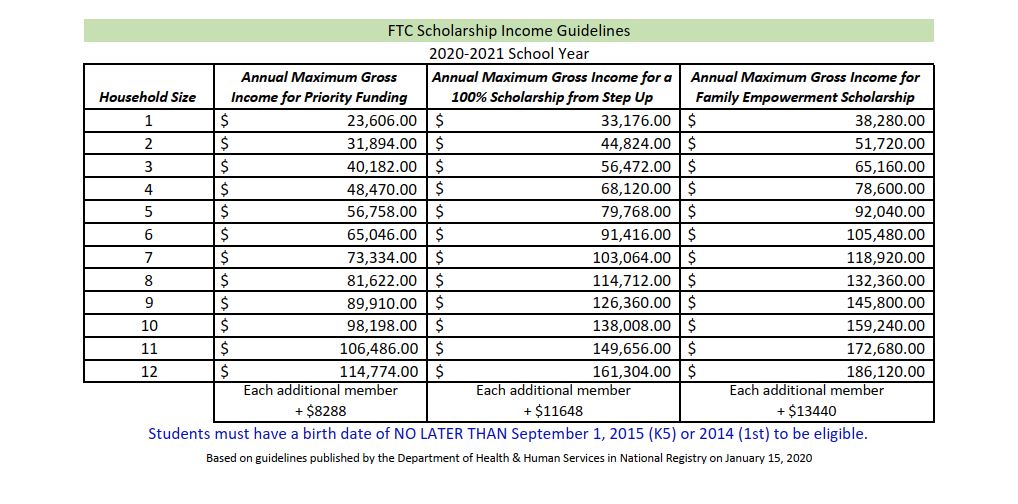

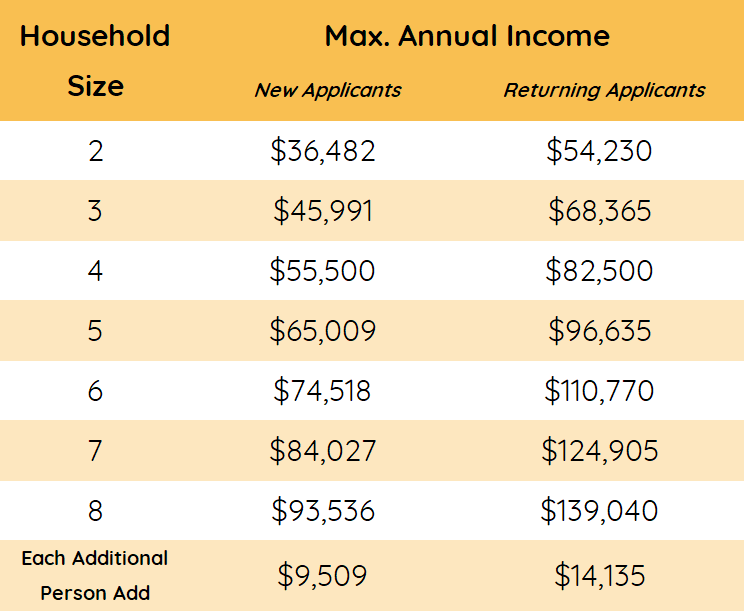

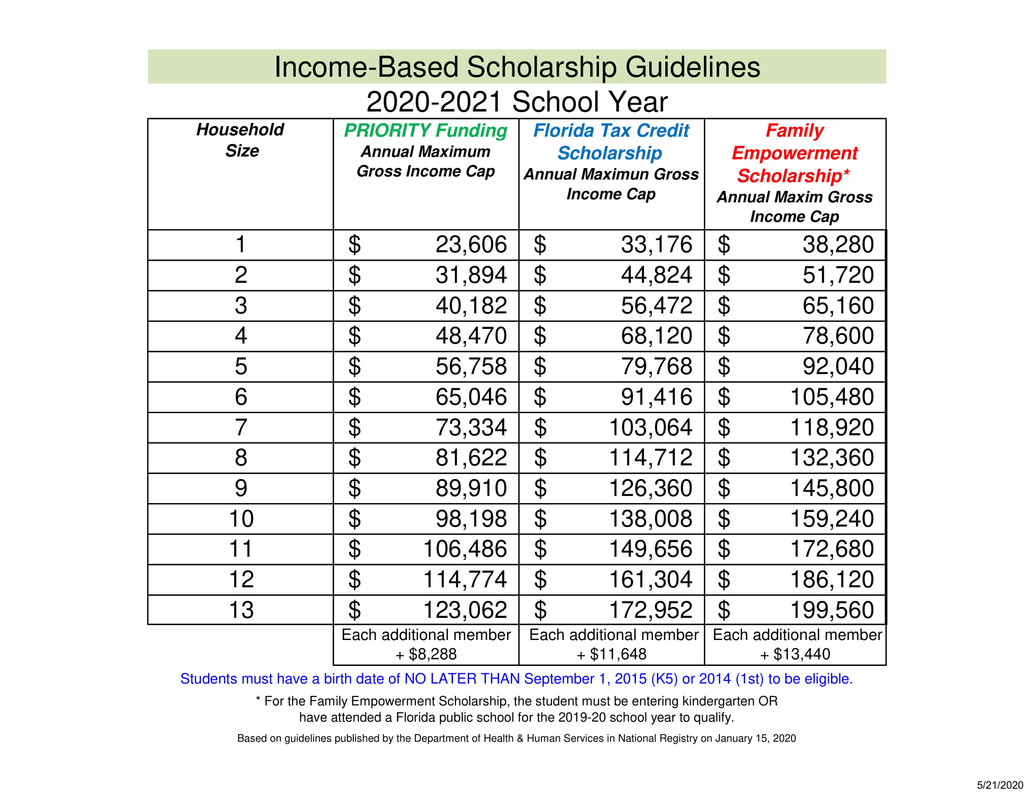

Income Requirements For Step Up Scholarship

Income Requirements For Step Up Scholarship - Each province and territory determines their own income tax rates. The government of canada sets the federal income tax rates for individuals. Income is reported and tax is calculated on an annual basis. It’s never been easier to do your taxes online. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. The old age security (oas) benefits estimator can help you estimate your. Personal income tax who should file a tax return, how to get ready and file taxes, payment and filing due dates, reporting income and claiming deductions, and how to make payments or. Last year, approximately 93% of. The payroll deductions online calculator (pdoc) calculates canada pension plan (cpp), employment insurance (ei) and tax deductions based on the information you provide. They have been replaced by the old age security benefits estimator. The old age security (oas) benefits estimator can help you estimate your. The rate tables are no longer available. It’s never been easier to do your taxes online. Personal income tax who should file a tax return, how to get ready and file taxes, payment and filing due dates, reporting income and claiming deductions, and how to make payments or. They have been replaced by the old age security benefits estimator. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. Income is reported and tax is calculated on an annual basis. In fact, online filing gets you access to the benefits, credits, and refunds you may be eligible for even faster! The government of canada sets the federal income tax rates for individuals. Last year, approximately 93% of. The payroll deductions online calculator (pdoc) calculates canada pension plan (cpp), employment insurance (ei) and tax deductions based on the information you provide. They have been replaced by the old age security benefits estimator. Personal income tax who should file a tax return, how to get ready and file taxes, payment and filing due dates, reporting income and claiming deductions,. They have been replaced by the old age security benefits estimator. Last year, approximately 93% of. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. Each province and territory determines their own income tax rates. Income is reported and tax is calculated on an annual basis. Income is reported and tax is calculated on an annual basis. Each province and territory determines their own income tax rates. The old age security (oas) benefits estimator can help you estimate your. They have been replaced by the old age security benefits estimator. Last year, approximately 93% of. Last year, approximately 93% of. The old age security (oas) benefits estimator can help you estimate your. They have been replaced by the old age security benefits estimator. Personal income tax who should file a tax return, how to get ready and file taxes, payment and filing due dates, reporting income and claiming deductions, and how to make payments or.. Personal income tax who should file a tax return, how to get ready and file taxes, payment and filing due dates, reporting income and claiming deductions, and how to make payments or. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. In fact, online filing gets you. Last year, approximately 93% of. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. The old age security (oas) benefits estimator can help you estimate your. Income is reported and tax is calculated on an annual basis. Personal income tax who should file a tax return, how. The old age security (oas) benefits estimator can help you estimate your. Personal income tax who should file a tax return, how to get ready and file taxes, payment and filing due dates, reporting income and claiming deductions, and how to make payments or. In fact, online filing gets you access to the benefits, credits, and refunds you may be. The government of canada sets the federal income tax rates for individuals. The old age security (oas) benefits estimator can help you estimate your. In fact, online filing gets you access to the benefits, credits, and refunds you may be eligible for even faster! Personal income tax who should file a tax return, how to get ready and file taxes,. They have been replaced by the old age security benefits estimator. The government of canada sets the federal income tax rates for individuals. The old age security (oas) benefits estimator can help you estimate your. The payroll deductions online calculator (pdoc) calculates canada pension plan (cpp), employment insurance (ei) and tax deductions based on the information you provide. Income is. In fact, online filing gets you access to the benefits, credits, and refunds you may be eligible for even faster! Income is reported and tax is calculated on an annual basis. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. The old age security (oas) benefits estimator. They have been replaced by the old age security benefits estimator. The rate tables are no longer available. Income is reported and tax is calculated on an annual basis. Each province and territory determines their own income tax rates. Netfile service in tax software that allows most people to submit a personal income tax return electronically to the canada revenue agency. Last year, approximately 93% of. In fact, online filing gets you access to the benefits, credits, and refunds you may be eligible for even faster! The payroll deductions online calculator (pdoc) calculates canada pension plan (cpp), employment insurance (ei) and tax deductions based on the information you provide. The old age security (oas) benefits estimator can help you estimate your.ADOM Step Up Scholarships for private school

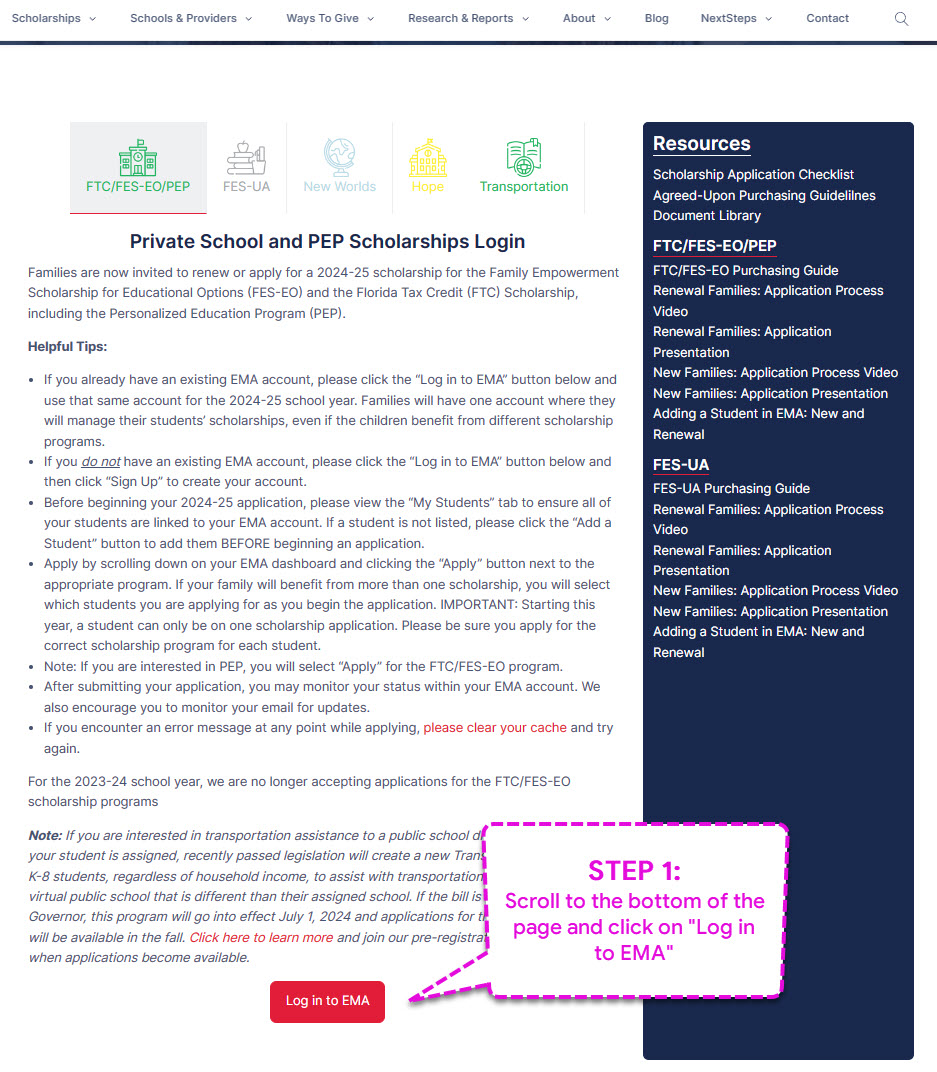

StepUp Scholarship Mother of Our Redeemer Catholic School

Scholarships and Tuition St. Malachy Catholic School Tamarac, FL

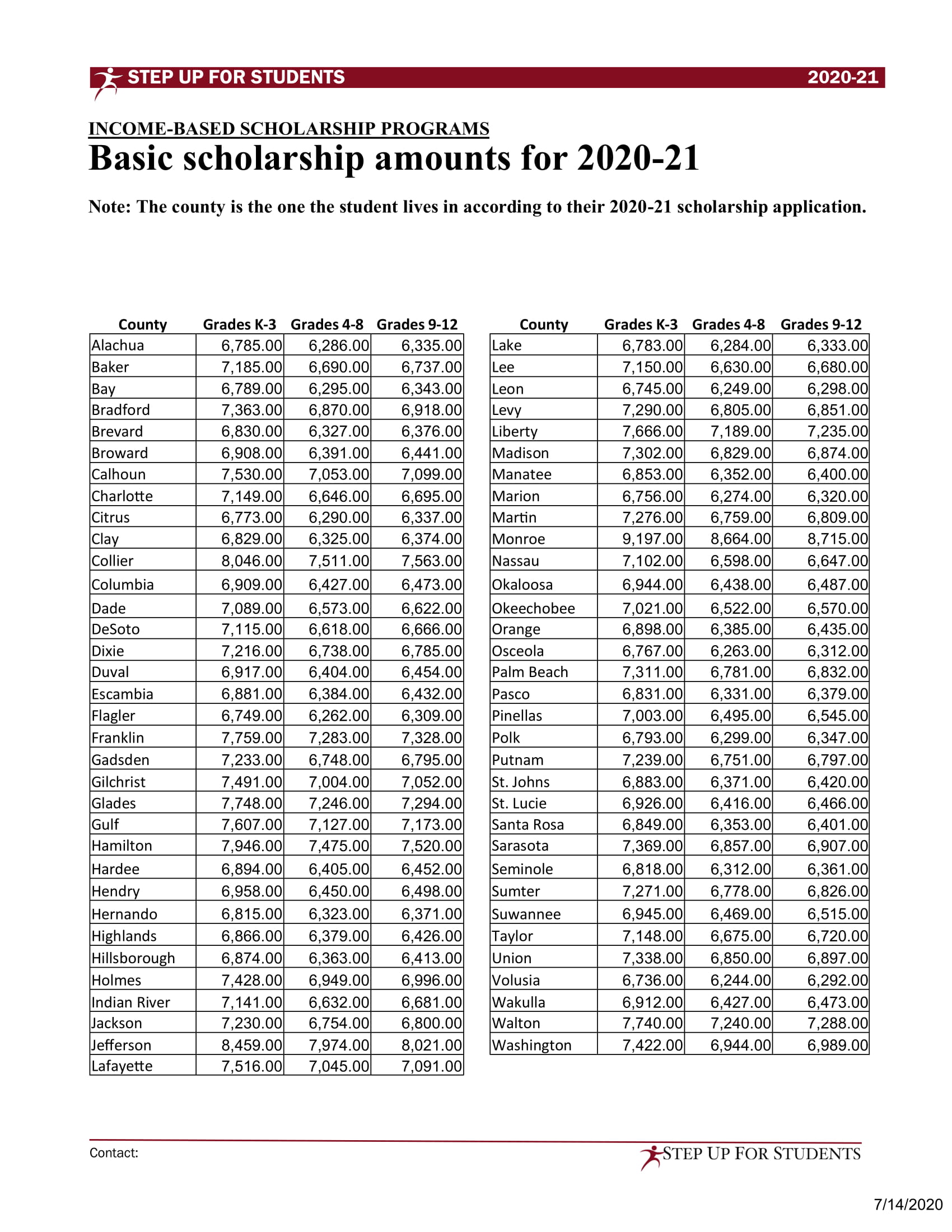

STEP UP Based Scholarship Amounts(1) 1 — Postimages

Financial Aid Ocala Adventist Academy

Financial Aid Ocala Adventist Academy

Apply Renaissance Scholarships

Step Up For Students Scholarship Applying & Information American

STEP UP Guidelines 2020 21 Combined FTC FES FINAL(1) 1 — Postimages

Step Up Scholarship Florida Program Everything To Know

The Government Of Canada Sets The Federal Income Tax Rates For Individuals.

It’s Never Been Easier To Do Your Taxes Online.

Personal Income Tax Who Should File A Tax Return, How To Get Ready And File Taxes, Payment And Filing Due Dates, Reporting Income And Claiming Deductions, And How To Make Payments Or.

Related Post: